tax shield formula cpa

As such the shield is 8000000 x 10 x 35 280000. Developing CCA Tax Shield Formula 1000000 asset 5 declining balance CCA rate 35 tax rate 10 discount rate Year UCC CCA 5 UCC End of Year CCA Tax Shield.

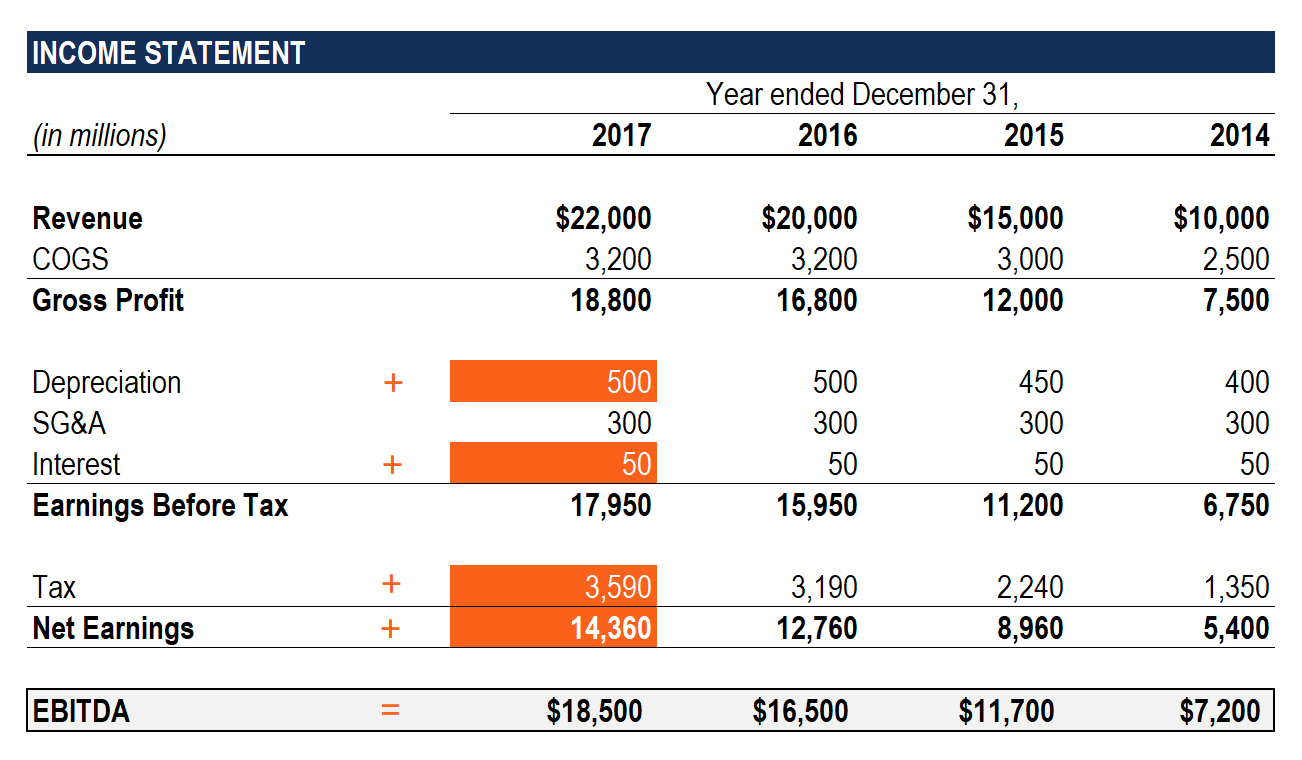

What Is Ebitda Formula Definition And Explanation

The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate.

. Based on the information do the calculation of the tax shield enjoyed by the company. CPA COMMON FINAL EXAMINATION REFERENCE SCHEDULE 1. Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company.

Depreciation Tax Shield 100000 20. Ad Ramsey tax advisors are redefining what it means to do your taxes right. Free Case Review Begin Online.

Investment Cost Marginal Rate of Income tax. Will receive as a result of a. Depreciation Tax Shield Depreciation Applicable Tax Rate.

Vetted Trusted by US Companies. The tax shield Johnson Industries Inc. PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of Total Tax Shield from CCA for a New Asset Notation for above.

To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give. Tax Shield formula. They want to give less of your money to the government and keep more in your paycheck.

Depreciation Tax Shield 20000. Thus if the tax rate is 21 and the business has 1000 of interest. Ad See If You Qualify For IRS Fresh Start Program.

CPA Canada s Reference Schedule of allowances and tax rates used in their Core evaluations Keywords. Operating Profit is calculated as. Ad Empowering the Future of Finance Work.

The formula for calculating a depreciation tax shield is easy. All you need to do is multiply depreciation expense for tax purposes not financial purposes and multiply by the effective. Depreciation tax shield 30 x 50000 15000.

Tax Shield Value of Tax Deductible - Expense x Tax Rate Example If. Present value PV tax shield formula. Based On Circumstances You May Already Qualify For Tax Relief.

Do the calculation of Tax Shield enjoyed by the company. Calculation of the tax shield follows a simplified formula as shown below. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate.

Ad See If You Qualify For IRS Fresh Start Program. Based On Circumstances You May Already Qualify For Tax Relief. The intuition here is that the company has an.

This is equivalent to the 800000 interest expense multiplied by 35. Tax Shield Amount of tax-deductible expense x Tax rate. PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of total tax shield from CCA for a new.

The applicable tax rate is 37. Ad Answer Simple Questions About Your Life And We Do The Rest. TABLE III A FORMULA FOR CALCULATING THE PRESENT VALUE OF REDUCTIONS IN TAX PAYABLE DUE TO CAPITAL COST ALLOWAICE.

Let us look at a detailed example when a company prepares its tax income 1 accounting for depreciation expense and 2 not. The maximum depreciation expense it can write off this year is 25000. Free Case Review Begin Online.

Interest Tax Shield Interest Expense Tax. For example if an individual has 2000 as mortgage interest with a tax rate of 10 then the. Calculating the tax shield can be simplified by using this formula.

Tax Shield Value of Tax-Deductible Expense x Tax Rate. The following is the Sum of Tax. CPA CFE REFERENCE SCHEDULE 2018 1.

Exclusive Network of Top-Tier Freelance Accountants. How to Calculate Tax Shield.

Times Interest Earned Tie Ratio Formula And Calculator

Free Cash Flow To Firm Fcff Formulas Definition Example

How Is Agi Calculated In Tax Universal Cpa Review

/dotdash_Final_EBITDA_To_Interest_Coverage_Ratio_Dec_2020-012-3a127232967d435d93bda56dd6b7211f.jpg)

Ebitda To Interest Coverage Ratio Definition

Times Interest Earned Tie Ratio Formula And Calculator

How To Npv Tax Shield Salvage Value Youtube

Operating Cash Flow Formula Examples With Excel Template Calculator

Tax Shield Formula Step By Step Calculation With Examples

Current Yield Meaning Importance Formula And More Finance Investing Learn Accounting Accounting Basics

Effective Interest Rate Formula Calculator With Excel Template

What Is Net Operating Profit After Taxes Nopat Definition Meaning Example

Tax Shield Formula Step By Step Calculation With Examples

What Is A Depreciation Tax Shield Universal Cpa Review

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

How To Calculate Interest Expense The Motley Fool

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)