kentucky property tax calculator

Kentucky Property Tax Calculator to calculate the property tax for your home or investment asset. 4 beds 35 baths 3417 sq.

Jefferson County Ky Property Tax Calculator Smartasset

See Results in Minutes.

. For most counties and cities in the Bluegrass State this is a percentage of taxpayers. 072 of home value Tax amount varies by county The median property tax in Kentucky is 84300 per year for a home worth the median value of 11780000. All property that is not vacant is subject to a 911 service fee of 75 for each dwelling or unit on the property.

All rates are per 100. Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. Overview of Kentucky Taxes.

Kentucky has a flat income tax rate of 5 a statewide sales tax of 6 and property taxes that average 1257 annually. Property tax is calculated based on your home value and the property tax rate. Todays Best 30 Year Fixed Mortgage Rates.

KRS 1322201aThe person who owns a motor vehicle on January 1 st of the year is responsible for paying the property taxes for that vehicle for the year. Explanation of the Property Tax Process. How Your Property Taxes Compare Based on an Assessed Home Value of 250000.

The median property tax on a 16950000 house is 122040 in Kentucky. If tax bills are mailed by October 1 taxpayers have until November 1 to pay their bill with a 2 discount. 2100 of Assessed Home Value.

The property tax calendar provides for delivery of the tax bills to the sheriff by September 15 of each year. Estimate Property Tax Our Allen County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Kentucky and across the entire United States. Most Kentucky property tax bills do not separately itemize the tax on inventory from taxes on other categories of tangible property.

Ad Download Property Records from the Kentucky Assessors Records. The annual appreciation is an optional field where you can enter 0 if you do not wish to include it in the KY property tax calculator. The states average effective property tax rate is 083.

Over the years the State real property tax rate has declined from 315 cents per 100 of assessed valuation to 122 cents due to this statutory provision. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Fayette County. Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats.

The tax estimator above only includes a single 75 service fee. 121 rows The typical homeowner in Kentucky pays just 1257 annually in property taxes around half the national median. Both the sales and property taxes are below the national averages while the state income tax is right around the US.

0930 of Assessed Home Value. Payment should be made to the County. Please note that this is an estimated amount.

It is levied at six percent and shall be paid on every motor vehicle used in. The median property tax on a 16950000 house is 177975 in the United States. Aside from state and federal taxes many Kentucky residents are subject to local taxes which are called occupational taxes.

Therefore the DOR Inventory Tax Credit Calculator is the. Zillow has 1471 homes for sale. However many counties wait until October 1 or November 1 to mail their tax bills.

Actual amounts are subject to change based on tax rate changes. The tax rate is the same no matter what filing status you use. Counties in Kentucky collect an average of 072 of a propertys assesed fair.

Property Valuation Administrators PVAs in each county must list value and assess the property tax on motor vehicles and motor boats as of January 1 st of each year. Local Property Tax Rates. Heartland MLS For Sale.

1070 of Assessed Home Value. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Shelby County. New York Enter your financial details to calculate your taxes Average County Tax Rate 1925 New York County Property Taxes 4813 Annual.

Our Kentucky Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Kentucky and across the entire United States. So if your home is worth 200000 and your property tax rate is. Estimate Property Tax Our Hardin County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Kentucky and across the entire United States.

Estimate Property Tax Our Owen County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Kentucky and across the entire United States. It is based ONLY upon the taxes regarding inventory. View listing photos review sales history and use our detailed real estate filters to find the perfect place.

This rate is set annually by July 1 and it applies to all real property tax bills throughout Kentucky. Look Up Any Address in Kentucky for a Records Report. The median property tax on a 15920000 house is 114624 in Kentucky.

Based on a 200000 mortgage. 15700 Kentucky Rd Belton MO 64012 575000 MLS 2365878 Dont miss this opportunity for your dreams to come true with this 3 story home on 5 acr. 0830 of Assessed Home Value.

Kentucky imposes a flat income tax of 5. 2160 of Assessed Home Value. In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components of the property tax system.

To estimate your real estate taxes you merely multiply your homes assessed value by the levy. Payment shall be made to the motor vehicle owners County Clerk. The median property tax on a 15920000 house is 167160 in the United States.

Annual How Your Property Taxes Compare Based on an Assessed Home Value of 250000.

Capital Gains Tax Calculator 2022 Casaplorer

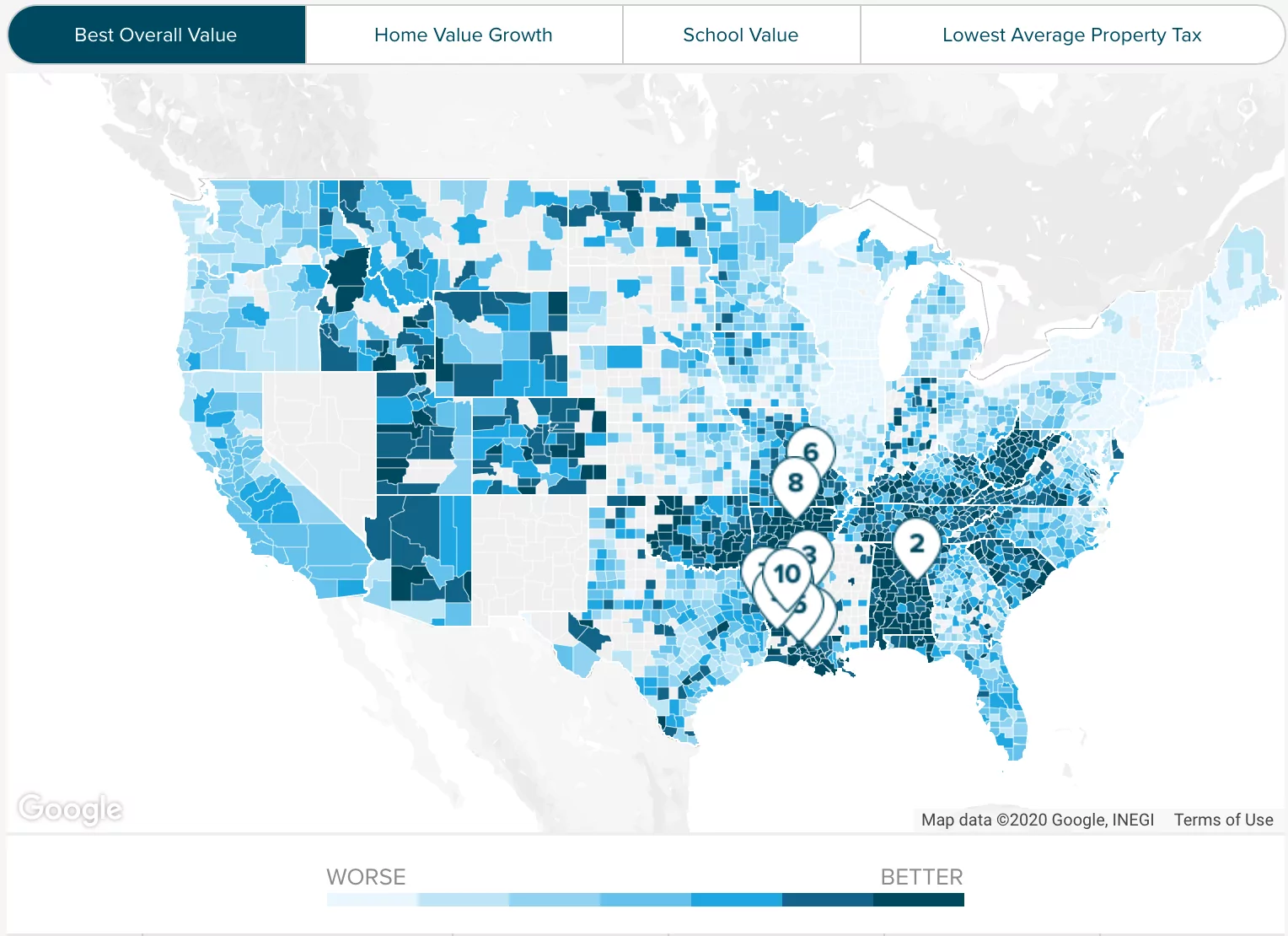

Kentucky Property Tax Calculator Smartasset

Kentucky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

North Central Illinois Economic Development Corporation Property Taxes

How Is Tax Liability Calculated Common Tax Questions Answered

Car Tax By State Usa Manual Car Sales Tax Calculator

Kentucky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

Kentucky Property Taxes By County 2022

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Property Taxes Calculating State Differences How To Pay

States With Highest And Lowest Sales Tax Rates

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered

Property Taxes By State County Lowest Property Taxes In The Us Mapped